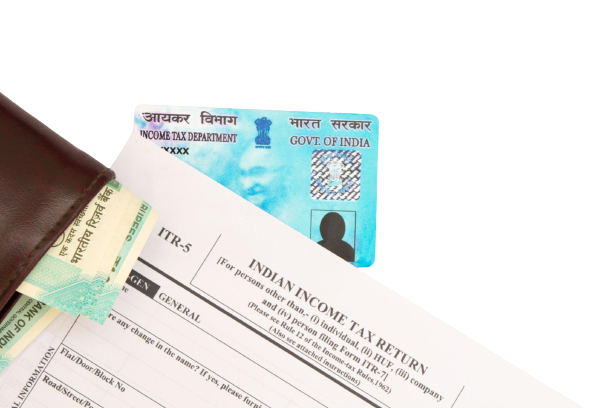

Income Tax Return

What is Income Tax Return ?

In India, an Income Tax Return (ITR) is a form that a taxpayer files with the Income Tax Department, which is part of the Central Board of Direct Taxes (CBDT), under the Ministry of Finance. The ITR form is used to report the taxpayer’s income, deductions, and tax liability for a particular financial year.

Every year, the Income Tax Department releases different types of ITR forms, based on the nature and source of income, the category of the taxpayer, and the type of return filed. For instance, ITR-1 form is for individuals with income up to Rs. 50 lakhs and having income from salary, house property, and other sources, while ITR-2 is for individuals and Hindu Undivided Families (HUFs) with income from capital gains or income from more than one house property.

The Income Tax Return serves as a record of the taxpayer’s income, tax payments made, and any refunds due. It is also used by the Income Tax Department to verify the accuracy of the taxpayer’s income and tax liability and identify any discrepancies or errors in the taxpayer’s tax returns. Filing an Income Tax Return is mandatory for individuals and companies whose income exceeds a certain threshold, and failure to file a return or under-reporting of income can result in penalties and legal action by the Income Tax Department.

Benefits of Income tax return filling

Filing an Income Tax Return (ITR) can provide various benefits, including:

- Avoid Penalties and Legal Consequences: Filing your Income Tax Return on time can help you avoid penalties and legal consequences for non-compliance with tax laws.

- Quick Processing of Loans: Many banks and financial institutions require ITRs as proof of income for loan applications. Filing ITR can make loan processing easier and faster.

- Claim Refunds: Filing ITR allows you to claim tax refunds if you have paid more tax than your actual tax liability. Refunds can be claimed only if you have filed your ITR.

- Establish Financial Credibility: ITR is considered as a proof of your financial credibility and can be used as evidence of your income for various purposes.

- Carry Forward Losses: If you have incurred losses in a particular year, you can carry forward these losses and set them off against future profits. However, this is possible only if you file ITR.

- Apply for Visas: ITR can be used as a proof of income for visa applications to foreign countries.

- Compliance with the Law: Filing ITR is a legal requirement, and complying with the law can help you avoid legal consequences and non-compliance penalties.

Filing ITR not only helps you comply with the law but also offers various benefits such as establishing financial credibility, claiming refunds, carrying forward losses, and applying for loans and visas.

DOn't know which return to file ?

Choose the right form according to your source of Income.

Who is eligible for ITR-1 form ?

ITR-1 is a one-page comparatively simpler form for individuals who do not have an income above ₹50 lakhs.

If you are wondering who is eligible for ITR-1, know that the income should be from the following sources:

- Income from salary or pension

- Income from one house property

- Income from other sources

If filing for clubbed income tax returns, where a spouse or a minor is included, it can be taken forward if only the above-mentioned eligibility for ITR-1 is met.

Who is eligible for ITR-2 form?

Resident individuals and Hindu Undivided Families (HUFs) who receive income from sources under the heading ‘Profits and Gains from Business or Profession’ can file ITR-2. Therefore, you are eligible to file income tax returns with an ITR-2 form if you earn income from the following sources:

- Salary or pension

- House property (including more than one residential property)

- Capital gains or losses on the sale of property or investments (includes both short as well as long-term investments)

- Income from other sources, such as winning rewards from lotteries, horse racing, etc.

- Agricultural income of more than ₹5,000

- Income accrued outside India (foreign income)

- Income from foreign assets

Additionally, a taxpayer who is a director of any company or has invested in unlisted equity shares of a company is required to file returns with ITR-2.

So, who does not come under this ITR-2 eligibility? The following category of taxpayers cannot file ITR-2:

- An individual or Hindu Undivided Family (HUF) that earns income from profession or business.

- Taxpayers who are eligible to file returns with the ITR-1 form.

Who is eligible for ITR-3 Form ?

An ITR-3 form is applicable to any individual or Hindu Undivided Family (HUF) whose total income for a given assessment year includes the following:

- Income from a profession or business carried under a proprietorship firm, wherein the taxpayer is a proprietor (both audit and non-audit cases)

- Income earned from one or multiple house properties

- Rewards earned by winning a lottery, horse racing, and other activities falling under ‘Income from Other Sources’

- Income assets by way of assets in a country outside India

- Income generated from short or long-term capital gains

Now that you know about ITR-3 eligibility.

Who is eligible to file the ITR-4 form?

Here is a list of who is eligible for ITR-4. If you fall under this category, you should declare your returns under the ITR-4 option.

The ITR-4 is filed by individuals or Hindu Undivided Families who are RNOR (resident other than not ordinarily resident) or a firm which is not a Limited Liability Partnership but is a resident and has an income not exceeding ₹50 lakhs for the year 2021-22. Also, their revenues fall under the following heads:

- Income received from a business where it is calculated on a presumptive basis under Section 44AD with a gross turnover of up to ₹2 crores. Alternatively, under Section 44AE, which is concerning income from up to ten goods carriages.

- Income received from a profession where this income is calculated on a presumptive basis under Section 44ADA with a gross receipt up to ₹50 lakhs.

- Income from salary or pension

- Income from one house property

- Interest income from the family pension which is taxable under other sources.

Points to Note:

- The presumptive income computed under Sections 44AD, 44AE, 44ADA are assumed to be calculated after consideration is given to every loss, allowance, depreciation, or deduction under Income Tax Act.

- If the income of a spouse or minor child is to be clubbed with the income of an assessee, use this form if the clubbed income falls within the ₹50 lakhs bracket.

The ITR Form 5 is a form suitable for bodies such as firms, Body of Individuals (BOIs), Limited Liability Partnerships (LLPs), Artificial Juridical Person (AJP), Association of Persons (AOPs), the estate of insolvent, the estate of deceased, investment fund, business trust, local authority, and co-operative society for filing the ITR. Any individual or entity belonging to the aforementioned categories is eligible for ITR 5 filing.

Who is eligible for ITR-6 form ?

ITR-6 is applicable for Companies other than Companies claiming exemption under Section 11(i.e. Income from property held for charitable or religious purposes).

Get Your ITR Filled by Experts.

Are you in search of experts who can take care of your taxes and related filings ? Connect with our Experts and get your ITRs Filed accurately.